Establish a productive private equity partnership

Drs. Navio Kwok, Katherine Alexander, Richard Davis | 8 November 2021

The attributes that investors and sellers rated as most important were among the least important for the opposite party.

Originally featured in Harvard Business Review.

After an unpredictable and turbulent start, the turn of the decade marks the private equity (PE) industry’s coming of age. Despite initial volatility, McKinsey’s annual review found that fundraising activity across private markets reached an all-time high of $7.3 trillion in 2020, of which PE accounted for 61% and was the biggest driver of this growth. Zeroing in on the U.S., PitchBook’s analysis indicated that PE deals and exits are on pace for a record-setting year in 2021.

Before making a purchase, prospective PE investors undertake a process called due diligence to ensure they understand what exactly they’re getting. It’s akin to a pre-purchase home inspection, which can expose red flags and reasons not to buy a property. Importantly, however, such inspections can also reveal issues that can be fixed and uncover latent value that was previously unknown.

While the PE industry’s resilience amid a global pandemic is a cause for celebration, one overlooked aspect of due diligence is a cause for concern. Most due diligence efforts center on investigating the nuts and bolts of a company — financials, legal, patents, corporate documents, etc. — that provide a good understanding of the business on paper. However, what’s often underestimated and overlooked is management due diligence, a process that provides insight into the target company’s management team and what it would actually be like to work with them.

Ultimately, deals and mergers succeed or flounder because of people, and issues can almost always be alleviated early on with a solid awareness of the players involved. For PE investors, this means finding investment-worthy businesses with management teams that are compatible with their goals. At the same time, management teams need to evaluate whether an investor will be a good fit for their culture and working style. As a result, a thorough two-way due diligence is critical for both parties to understand whether the match is right and to ensure they can meet each other’s expectations in the partnership.

To date, no systematic research has unearthed what these expectations are, presenting an opportunity to illuminate this critical aspect of the due diligence process and contribute to the surprisingly little research on due diligence in general. Extending beyond due diligence, research by accountants and economists reveals that over 50% of the value of a firm cannot be explained by its financials, further underscoring the importance of intangibles such as management capabilities and personalities on the success of PE transactions.

Opening the black box of management due diligence and highlighting the process from both sides of the transaction, we surveyed 50 North American PE industry executives, comprising 25 managing directors of middle-market firms and 25 members of management teams at target companies that were previously owned by the PE firms. The problems associated with managing business relationships are perennial and the underlying principles to create and maintain successful partnerships are widely applicable. In studying and answering the following three research questions, we offer fundamentals for establishing productive and flourishing PE partnerships.

How do investors and sellers view management due diligence?

First, there is a disconnect between investors’ due diligence efforts and their awareness of the benefits. While they believe operations, products, and management capabilities all contribute equally to the success of a PE deal, their due diligence activities skew toward the former two.

Second, investors have inaccurate assumptions about how sellers view management assessments. Over one in four investors interviewed do not use external assessments because they believe it introduces potential friction to the relationship being forged with the seller, yet two-thirds of sellers interviewed find the experience to be positive (with the remainder viewing it neutrally).

Given an extensive business and operational due diligence phase, investors are often convinced their investment is sound and prematurely assume there is no need to investigate the management team any further. The insights gleaned from the first research question are a stark reminder for investors that each component contributing to the success of a PE transaction warrants equal attention during due diligence. While investors think management due diligence can impede the budding relationship with sellers, in reality, sellers find the process fruitful.

What characteristics do both parties look for in each other in a partnership?

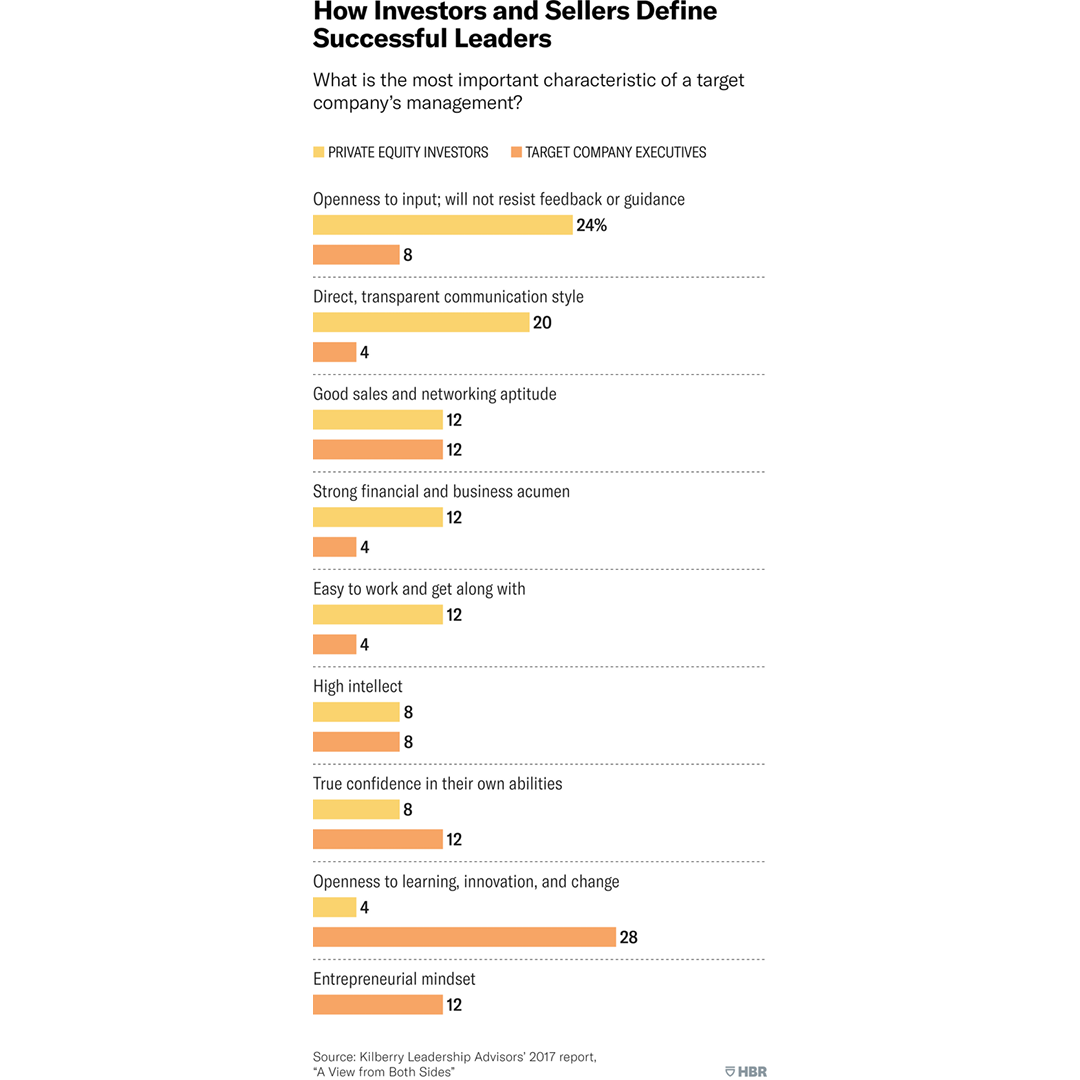

First, investors and sellers define successful entrepreneurial leaders/CEOs differently. When asked which characteristic is most important for a target company’s management, a surprising finding emerged: The attributes that investors and sellers rated as most important were among the least important for the opposite party. For instance, three times as many investors (24%) rated openness to input as most important than did sellers (8%). On the opposite end, seven times as many sellers (28%) rated openness to learning as most important than did investors (4%).

The attributes that investors and sellers rated as most important were among the least important for the opposite party.

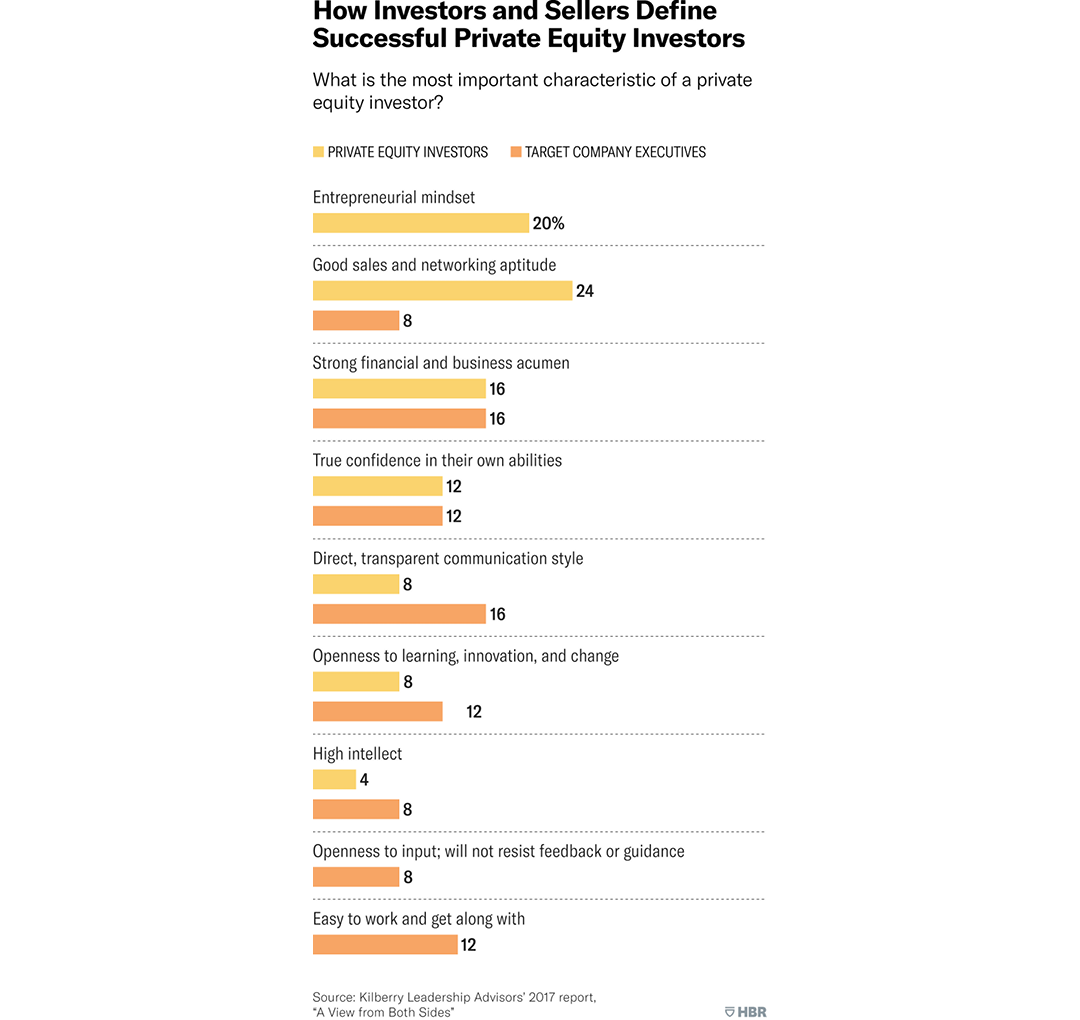

Second, investors and sellers define successful PE investors differently. Compared to the ratings of management, there was more overall agreement among both parties on the characteristic that is most important for an investor; however, a similar discrepant pattern still emerged. For example, 20% of investors rated entrepreneurial mindset as most important, while no sellers did. Likewise, whereas 12% of sellers rated ease of working together as most important, no investors rated that characteristic as most important.

Taken together, these findings emphasize the importance of a two-way dialogue that aligns what success looks like and articulates the value that investors and sellers are bringing to — and seeking in — the partnership. It is crucial that this alignment is established early on to ensure both parties know what to expect and to lay a solid foundation to build the relationship on.

What aspects of the partnership do both parties value and find challenging?

The data from the third research question uncovered three notable insights that spotlight the opaque relationship that exists between investors and sellers.

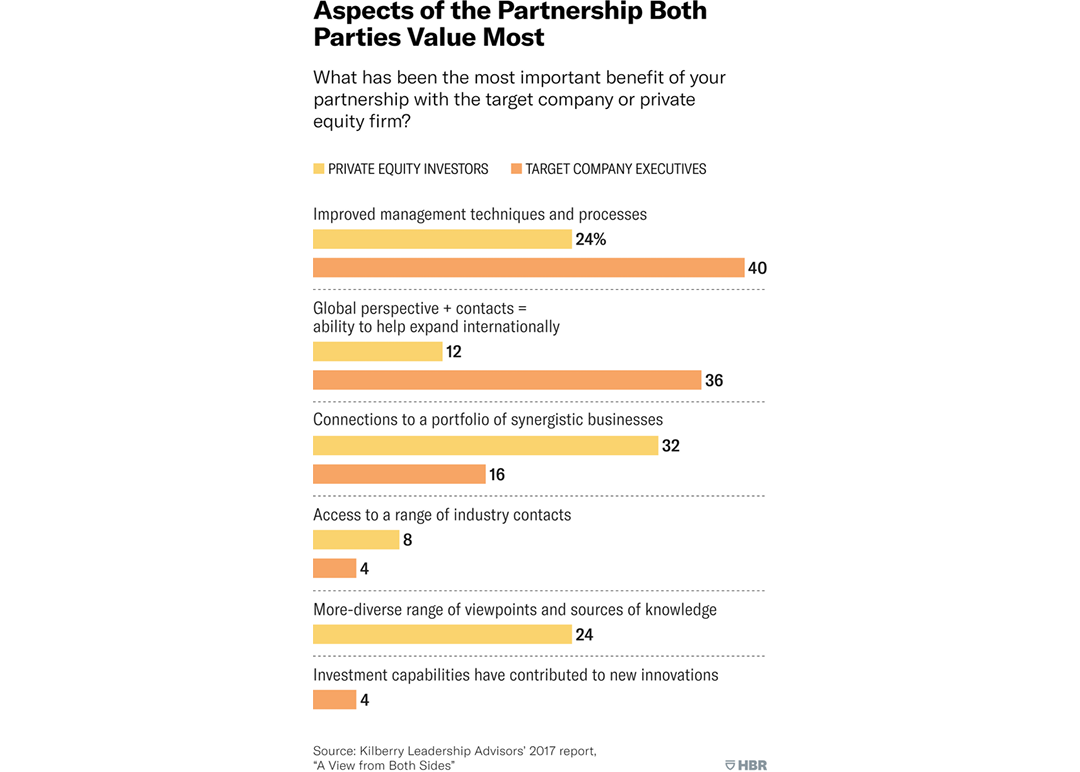

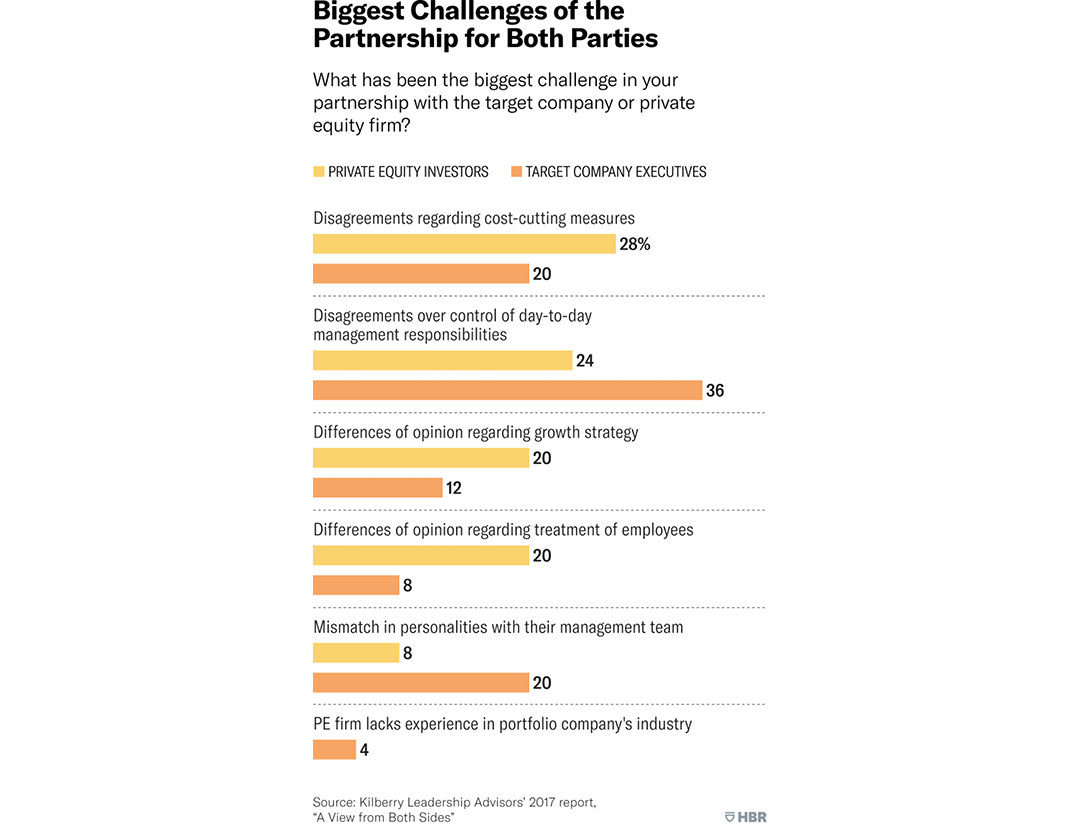

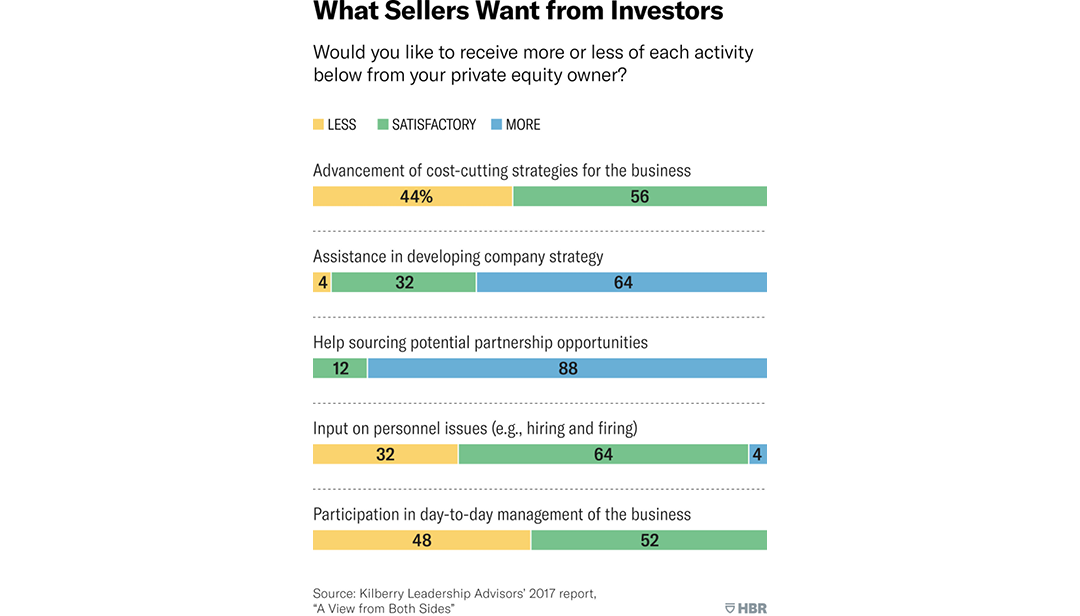

First, on the aspects both parties value and find challenging, a paradoxical finding emerged for sellers. While they indicated an improvement in management techniques as the most important benefit from their partnership with investors, sellers also pointed to disagreements over the day-to-day control of management responsibilities as the biggest challenge. This suggests that while sellers are looking for guidance in managing the company, they will resist a heavy hand. For investors, it will be critical to identify the Goldilocks zone of mentorship that is just right for your specific portfolio company.

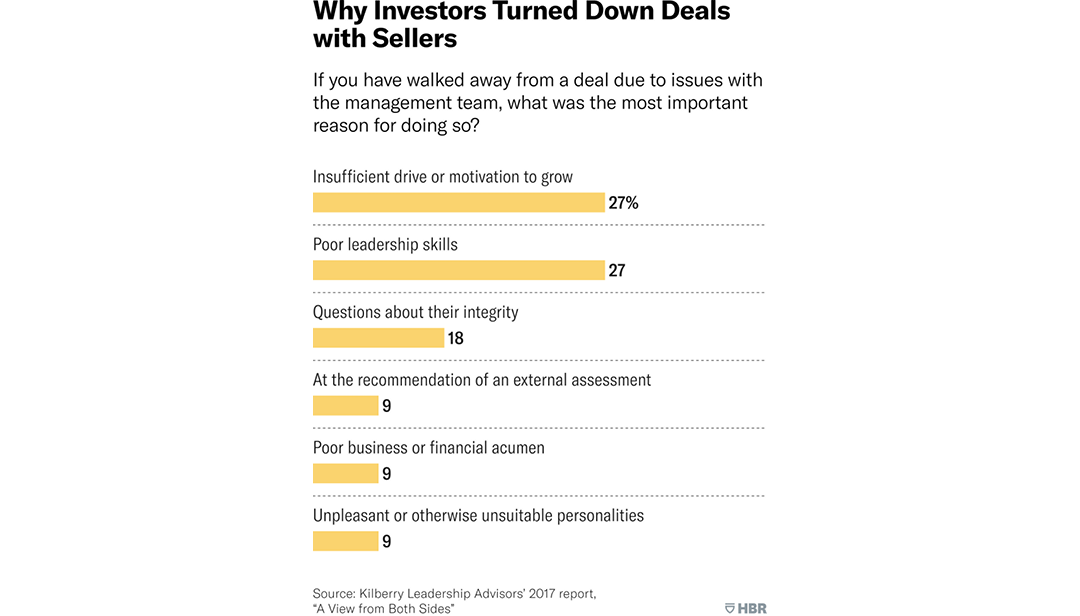

Second, both investors (44%) and sellers (36%) interviewed have walked away from deals. Among the top reasons for investors leaving is poor leadership skills on the part of sellers’ management team. As previously noted, how investors define a good CEO is different from sellers, so an up-front conversation about how both parties conceptualize effective leadership is critical.

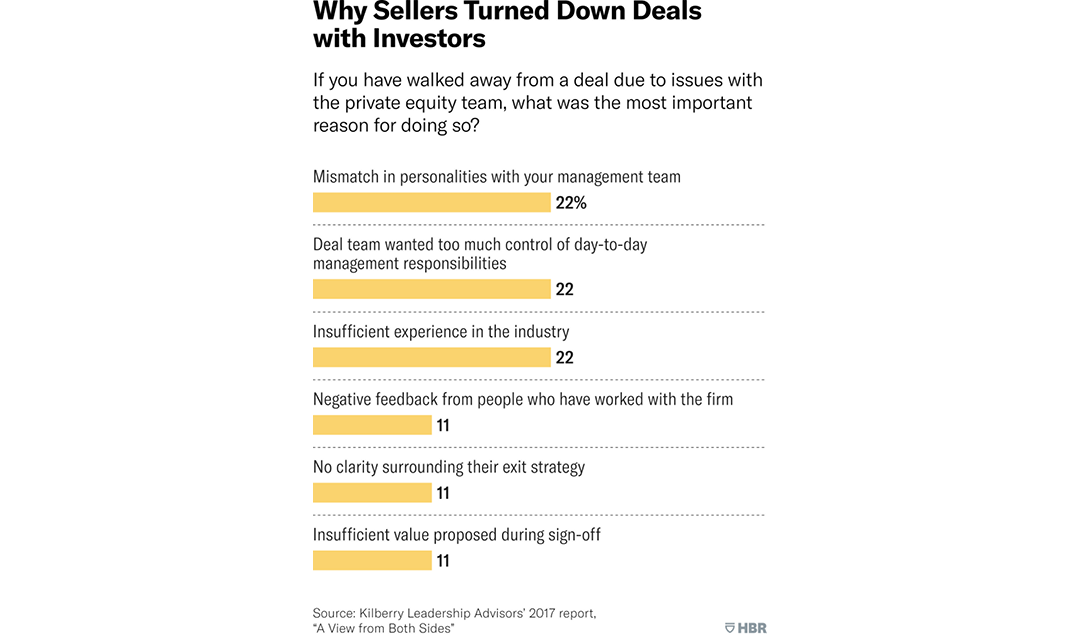

One of the top reasons for sellers walking away from a deal includes investors wanting too much day-to-day control, which is counter to what sellers value most in a partnership — as noted above, this stresses the importance of finding the perfect balance of investor mentorship and management autonomy. Sellers have also walked away from deals due to a mismatch in personalities with investors, which stresses the importance for sellers to be clear about the type of investor they want to partner with and not be clouded by the financial resources alone when making this decision.

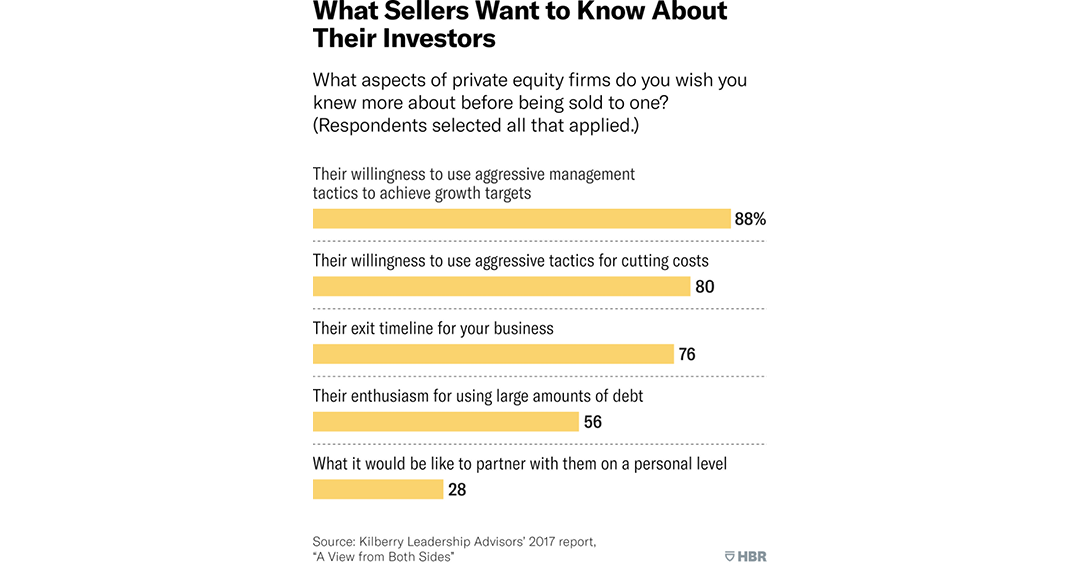

Most research on PE deals is from the perspective of investors, such as how firms select target companies, replace CEOs, or make companies more innovative. As such, it can be difficult for sellers to find out what it’s like to partner with a PE firm. Focusing on sellers, whose perspective is overlooked in the literature, we asked which aspects they wanted more or less of and wished they had known.

The number-one activity sellers want more of is sourcing additional partnership opportunities, which indicates that beyond financial capital, sellers also want access to investors’ networks. While sellers want more assistance in developing company strategy, they also wish they had known investors’ aggressive tactics to achieve growth targets and cut costs. Therein lies the importance for investors to not only explore other options to grow the company, but also to articulate why the strategies they employ are most appropriate and to calibrate their initiatives with management expectations without sacrificing value. Unsurprisingly, sellers also want less day-to-day participation from investors.

With the PE industry on track for a record-setting year, understanding the overlooked but critical aspect of management due diligence has never been more timely and relevant. Overall, the findings from our research culminate in three main fundamentals for establishing productive and flourishing PE partnerships:

- Investors should spend more time on management due diligence. Not only does it contribute to the success of PE transactions, but sellers do not find that formal assessments hinder the emerging relationship.

- Investors and sellers should have up-front discussions to align on what a successful partnership looks like, which can expose latent benefits and needs.

- It will be important to deliberate the reasoning behind why decisions are made and to calibrate activities to each other’s preferences while not sacrificing value.